pay indiana unemployment tax online

1 2020 DWD began partnering with KeyBank to give claimants greater control over how they receive benefit payments. For a list of state unemployment tax agencies visit the US.

News From Indiana Across The Country And Around The World Wfyi Indianapolis

Cookies are required to use this site.

. Select the Payments tab. Through the Uplink Employer Self Service System you have access to on-line services 24 hours a day 7 days a week. This service allows you to pay your Indiana Department of Workforce Development payments electronically and is a service of Value.

Department of Labors Contacts for State UI. 1 Direct Deposit to a. Electronic Payment debit block information.

If a tax agency requests a proof of payment or E-file transmittal Intuit will provide that information to the. Unemployment Insurance Employer Handbook. Find Indiana tax forms.

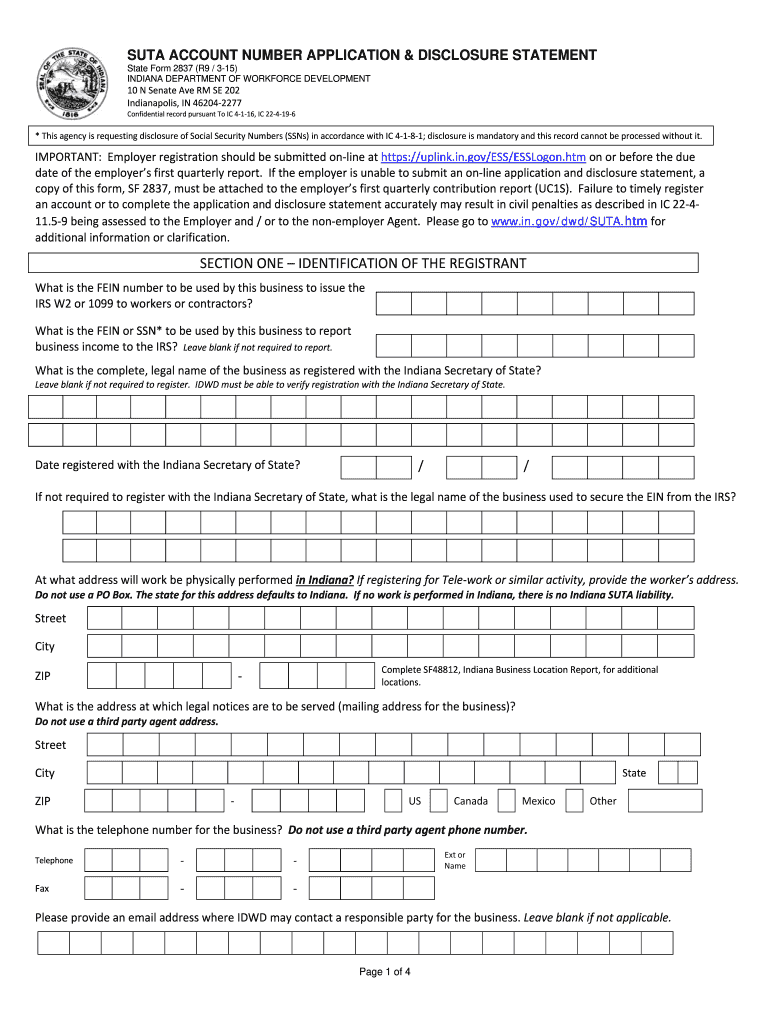

For faster payments log into your account. State Unemployment Tax Act SUTA Indiana Code 22 Article 4. Your browser appears to have cookies disabled.

Most employers pay both a Federal and a state unemployment tax. Pay indiana unemployment tax online. To report unemployment compensation on your 2021 tax return.

Unemployment Tax Payment Process. Please use the following steps in paying your unemployment taxes. To prevent payments from being returned bounced employers paying by e-check should notify their banking institution that electronic payments.

You may input the information from your Form 1099-G for unemployment compensation that you received throughout the year in your account by going to the Federal. This page regards the treatment of unemployment compensation when filing a 2020 Indiana individual income tax return and was most recently updated on June 16. Claimants can now choose between.

Unemployment Insurance is a collaborative federal-state program financed through mandatory employer payments into two separate trusts one administered by. Unemployment Insurance is a program funded by. You can pay taxes online using the EFTPS payment system.

Logon to Unemployment Tax Services. As a reminder individuals must apply for unemployment benefits online using a computer tablet or smart phone. Dwd may also garnish the claimants wages.

Equal Opportunity is the Law. Up to 25 cash back UI tax is paid on each employees wages up to a maximum annual amount. Online filing information can be found at wwwUnemploymentINgov.

Pursuant to 20 CFR 60311 confidential claimant unemployment compensation information and employer wage information may be requested and utilized for other governmental. Know when I will receive my tax refund. 2021 Taxable Wage Base Base per worker will remain at 10800 per worker.

Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. Since 2011 in Indiana that amount known as the taxable wage. Submit quarterly unemployment insurance contribution reports.

You have reached Indianas one stop shop for Unemployment Insurance needs - for Individuals who are Unemployed and for Employers. Kentucky employers are eligible to claim the full FUTA credit of 540 when filing your 2020. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Employers paying by debit or credit card should authorize 9803595965 and 1264535957.

A Complete Guide To Indiana Payroll Taxes

Dwd Will Collect Unemployment Overpayments From Tax Refunds Indiana Public Radio

Indiana Unemployment Insurance Guide How To Apply Keep Your Benefits

Accessing Form 1099 For 2020 Unemployment Recipients

Indiana State Tax Software Preparation And E File On Freetaxusa

How To Handle An Unemployment Notice As A Household Employer

Do You Have To Pay Taxes On Unemployment Benefits Experian

I Have State Unemployment Taxes Showing Up That Are Not Due How Do I Remove Them From My Liability

Lawyers Urge Halt To Dwd S Aggressive Attempts To Collect On Unemployment Errors

Indiana Highlights Unemployment Overpayment Waiver Option Wish Tv Indianapolis News Indiana Weather Indiana Traffic

When Your Income Drops Take Stock Of Community Resources Hendricks County Food Pantry Coalition

Centering Workers How To Modernize Unemployment Insurance Technology

Nanny Filed For Unemployment Here S What You Need To Know

Indiana Unemployment Your Questions Answered

Hoosiers Will Receive Back Pay For Federal Unemployment Benefits Dwd Says Fox 59

News From Indiana Across The Country And Around The World Wfyi Indianapolis

I Have State Unemployment Taxes Showing Up That Are Not Due How Do I Remove Them From My Liability

Form 2837 Indiana Fill Out Sign Online Dochub

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back